What Salary Do You Need for $1,500 Rent? (Real Math, No Fluff)

Quick answer (the numbers you actually came for)

Most renters are blocked by income requirements before anything else. Here are the common targets:

“Just qualify” target (3x rent rule):

$4,500/month gross → $54,000/year

“Safer budget” target (rent ≈ 30% of gross income):

$5,000/month gross → $60,000/year

Real-world version (rent + utilities):

If utilities/fees add ~$250/month, your housing cost becomes $1,750, which pushes the “30% rule” target to about $70,000/year.

That “30%” standard is widely used in affordability definitions (and it typically counts rent + utilities).

Also, you’re not imagining it: rent strain is common. The United States Census Bureau reported nearly half of renter households were cost-burdened (paying more than 30% of income toward housing).

1) The rules landlords actually use (so you don’t get surprised)

There isn’t one universal standard, but these show up constantly:

2.5x rent: more flexible (common with smaller landlords)

3x rent: the most common baseline

3.5x–4x rent: stricter properties/markets (or if your credit/rental history is shaky)

Gross income (pre-tax) is usually what they check for the ratio

Your budget should be based on take-home pay, not vibes

2) The math (save this—this is the whole game)

Formula A: “3x rent” income requirement

Monthly gross income needed = Rent × 3

For $1,500 rent:

$1,500 × 3 = $4,500/month

$4,500 × 12 = $54,000/year

Formula B: “30% rule” affordability target

Annual gross income needed = (Rent × 12) ÷ 0.30

For $1,500 rent:

($1,500 × 12) ÷ 0.30 = $60,000/year

Converting salary to hourly wage (40 hours/week)

Hourly ≈ Annual salary ÷ 2,080

$54,000/year ≈ $25.96/hour

$60,000/year ≈ $28.85/hour

For context, the National Low Income Housing Coalition (National Low Income Housing Coalition) reported a national “Housing Wage” of $28.17/hour for a modest one-bedroom in 2025 (method assumes 30% of income, full-time work).

3) Salary targets table for $1,500 rent (common screening thresholds)

| Standard | Monthly gross income needed | Annual salary needed | Hourly wage (approx.) |

|---|---|---|---|

| 2.5x rent | $3,750 | $45,000 | $21.63/hr |

| 3x rent | $4,500 | $54,000 | $25.96/hr |

| 3.5x rent | $5,250 | $63,000 | $30.29/hr |

| 4x rent | $6,000 | $72,000 | $34.62/hr |

| Rent = 30% of gross income | $5,000 | $60,000 | $28.85/hr |

Translation:

If you’re trying to get approved, $54k/year is the classic “3x rent” line.

If you’re trying to live without drowning, $60k–$70k is more realistic once utilities and recurring fees show up.

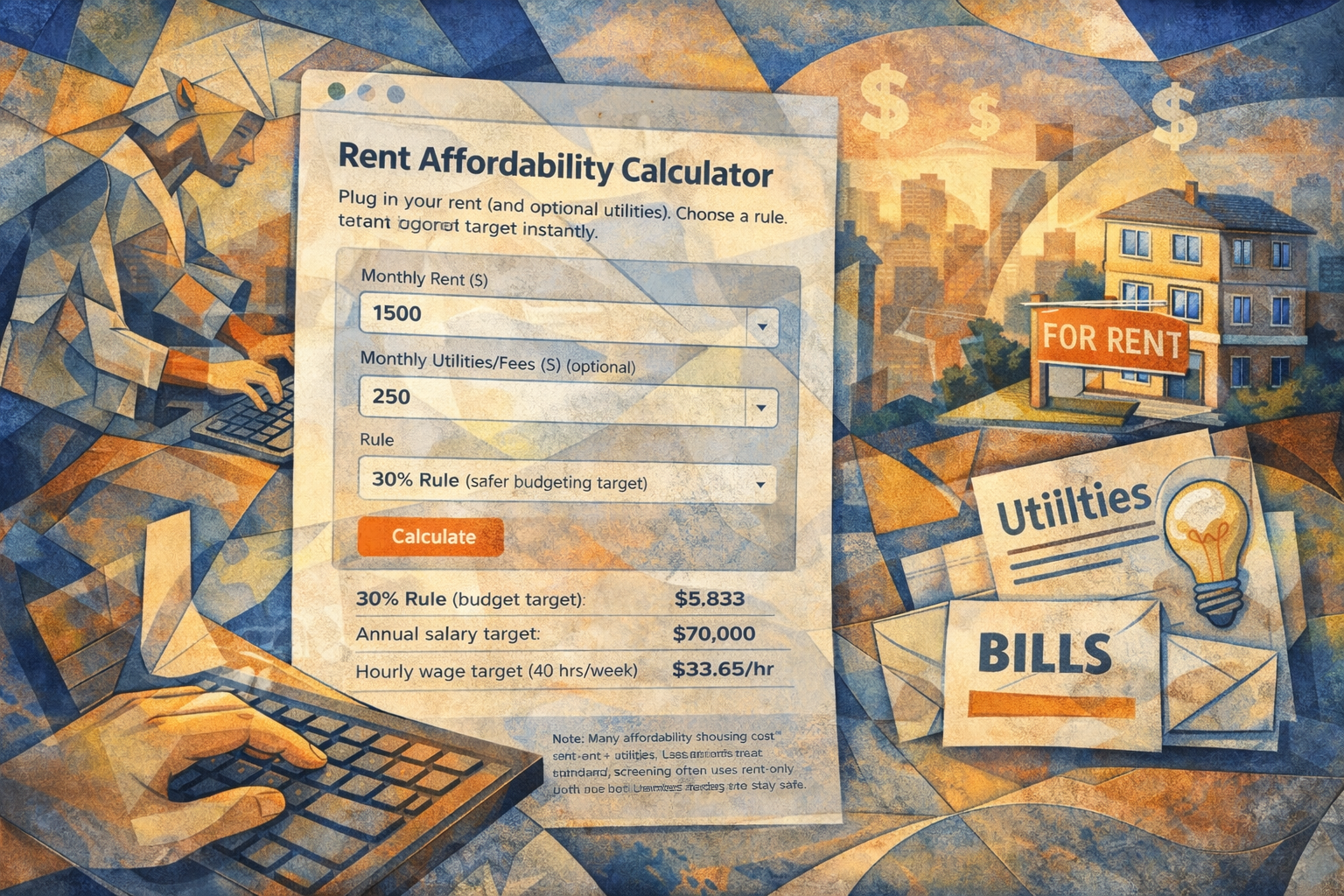

Rent Affordability Calculator

Plug in your rent (and optional utilities). Choose a rule. Get the income target instantly.

Note: Many affordability standards treat “housing costs” as rent + utilities. Landlord screening often uses rent-only for the multiplier. Use both numbers to stay safe.

5) The hidden costs that make $1,500 rent feel like $1,900

Here’s where budgets go to die (quietly):

Utilities: electricity, gas, water, trash (sometimes billed separately)

Parking: especially in newer builds

Renter’s insurance: often required

Internet: you will pay it, no matter how much you deny it

“Resident benefit package” fees: common with property management companies

Move-in costs: application fees + admin fees + deposit + first month (often 2–3x rent upfront)

Practical reality: Even if you “qualify” at $54k, your month-to-month comfort might still require closer to the $60k–$70k zone once everything is counted.

6) What if you don’t make enough for $1,500 rent?

No shame—just strategy.

Options that actually work (no magic tricks)

Roommate / shared housing: drops your personal ratio fast

Find a landlord using 2.5x (not 4x): smaller landlords can be more flexible

Pay more upfront (if you can): some owners will accept higher deposit / multiple months

Use a legitimate guarantor / co-signer pathway: this is a real lane, not a hack

Target properties with alternative approval programs

Second Chance List was built around those “approval pathway” realities (not wishful thinking) and positions itself as a resource for renters facing credit/rental-history barriers. second chance list website

If you’re going the program route, our internal workflow is basically:

pick a few properties first, then match to a guarantor / second-chance program and contact them with your shortlist. New SCL PDF

If you’re qualifying on income but getting blocked by screening (credit, eviction history, broken lease, background flags), the fastest “no-drama” shortcut is a curated directory of legit second chance lists.

Conclusion: So… what salary do you need for $1,500 rent?

If you’ve read this far, you already know the truth: rent affordability isn’t a vibe. It’s math + screening rules + real-life expenses that show up like uninvited guests. And if you’re trying to rent in 2026, you don’t just need to “afford” $1,500—you need to qualify for it, survive it month to month, and still have enough breathing room to handle life when it does what life always does.

Here’s the clean wrap-up, in plain English.

The core answer (the one you came for)

There are two different “answers” depending on your goal:

To qualify for $1,500 rent (typical landlord screening):

Most places want 3x rent in gross income (before taxes).

That’s $4,500 per month, or $54,000 per year.To afford $1,500 rent comfortably (real budgeting):

A common affordability target is keeping rent at about 30% of gross income.

That puts you closer to $60,000 per year.

And then there’s the third answer most people ignore until it’s too late:

To afford $1,500 rent in the real world (rent + utilities + fees):

If utilities and recurring fees push your housing cost to $1,700–$1,900, your safer salary target increases fast.

Translation:

You might technically qualify at $54,000, but you may not feel “stable” unless you’re closer to $60,000–$70,000 depending on your full monthly load.

The part that trips people up: “qualify” ≠ “afford”

A lot of renters get caught in a loop because they only focus on the approval math.

Landlord math is often simple:

“Do you make enough?”

“Is your credit acceptable?”

“Any red flags in your rental history?”

But your personal math is different:

“What’s left after taxes?”

“What’s left after your car payment, childcare, insurance, groceries?”

“What happens if your job cuts hours or a surprise bill hits?”

That’s why using both the 3x rent rule and the 30% rule is smart. One helps you predict approval odds. The other helps you avoid slowly bleeding out financially after you move in.

The “hidden costs” that turn $1,500 into “why am I broke?”

This is where the budget usually gets ambushed:

Utilities (some properties bill water/trash separately)

Parking

Renter’s insurance

Internet

Monthly “resident benefits” packages (common with management companies)

Application + admin fees

Move-in costs (deposit + first month + sometimes more)

So even if your rent is $1,500, your housing expense can behave more like:

$1,650

$1,750

$1,900

That’s why a tool that lets you plug in rent and utilities is more than a “nice to have.” It’s the difference between a plan and a fantasy.

The point of the tool (and why it matters)

The calculator and table aren’t just extra content—they’re the practical part of the post.

They help you:

Run the numbers instantly

See the income targets across multiple screening standards (2.5x, 3x, 3.5x, 4x, and the 30% budget rule)

Convert the target into something real like hourly pay, not just annual salary

That last piece matters because people don’t live inside annual salaries. They live inside paychecks.

If you’re hourly, the question becomes:

“Do I need $26/hour or closer to $29/hour?”

“Is this doable with one job, or do I need overtime, a second income stream, or a cheaper unit?”

Now you’re making decisions with clarity instead of hope.

Quick “rent readiness” checklist (use this before you apply)

If $1,500 rent is your target, here’s a no-nonsense pre-application check:

Income check: Do you meet the property’s multiplier (2.5x–4x)?

Budget check: After all housing costs, do you still have cushion?

Move-in cash check: Can you handle deposit + fees without going into panic mode?

Paperwork check: Do you have recent pay stubs, offer letter, bank statements if needed?

Plan B check: If they deny you, do you know your next best option before you waste more application fees?

This is how you stay in control of the process. Otherwise, the process controls you.

If you don’t hit the number, you still have options (legit ones)

Not making $54,000+ right now doesn’t mean you’re done. It means you need a different route.

Realistic pathways include:

Roommate/shared housing to reduce the rent burden

Smaller landlords who may use 2.5x instead of 3.5x or 4x

Units with utilities included (less surprise math)

Legitimate co-signer or guarantor arrangements (when that’s available)

Second-chance leasing options if screening criteria are your blocker, not income

And I’ll say it plainly: don’t get scammed chasing shortcuts. If anyone promises “guaranteed approval” for a fee with zero documentation, treat it like expired milk. Walk away.

The real takeaway

If you want the clean answer:

$54,000/year is the common screening threshold for $1,500 rent (3x rent).

$60,000/year is the more stable budget target (rent near 30% of gross income).

If utilities/fees stack up, you may need more to stay comfortable.

That’s the whole picture: approval math + survival math.

Next step (if you’re tired of guessing)

If you’re running into denials because of screening issues (credit challenges, prior rental issues, or other flags), a curated directory can save you time and application fees by pointing you toward more realistic options.

Get that list here

No hype. Just a shortcut for people who don’t have time to keep taking expensive “no’s” in the face.

Light disclaimer

This article is general educational information. Income requirements and screening policies vary by property, city, and management company. Always confirm requirements with the actual leasing office or landlord before applying.

FAQ (real renter search intent)

Is $50,000 enough for $1,500 rent?

Maybe for a 2.5x income property, but many 3x properties will say no.Do landlords count gross or net income?

Usually gross income for the ratio. Your personal budget should use take-home.What if I have high debt (car note, child support, loans)?

You can “pass” income ratio and still fail overall risk screening. Debt-to-income matters.Does the 30% rule include utilities?

In many affordability definitions, yes—housing costs include utilities.How much should I make per hour for $1,500 rent?

Roughly $26/hr to qualify (3x) and $28.85/hr to stay near 30%.What if the property requires 3.5x or 4x?

Your target jumps fast—use the table (or the calculator) and decide if it’s worth it.Can I get approved with bad credit if I make enough?

Sometimes yes, sometimes no—depends on the property’s screening policy and alternatives available.Is paying several months upfront always allowed?

Not always. Some landlords won’t accept it for policy reasons—ask before you apply.